Embark on a journey towards growth and success with the Curlec Partner Programme. As a homegrown success story that has evolved into a formidable force in the payment industry, we want to empower you with the tools and expertise to elevate your business. And we know building strong relationships is key to collective success. So let’s explore the ins and outs of the programme, unlocking the doors to mutual prosperity.

Get To Know the Curlec Partner Programme

At the heart of our mission is the belief that collective success is forged through collaboration. The Curlec Partner Programme embodies this value, inviting business to join forces and leverage on respective strengths; it’s a strategic alliance. As a partner, this initiative offers you a unique opportunity to extend our cutting-edge products to your clients, creating a meaningful and resourceful relationship that fuels revenue growth.

Benefits of Being A Partner

Being a Curlec partner comes with plenty of benefits such as:

- Opportunity to expand your revenue stream: Diversify income and explore fresh growth opportunities as you will receive monetary rewards by referring Curlec products to your customers

- Best-in-industry support: Benefit from local, on-ground support. Ensuring seamless integration and navigation of challenges.

- Competitive rates: Enjoy pricing structures that give you a competitive edge in the market.

- Long-term relationships: Build enduring partnerships that promise mutual prosperity and success.

Who Can Be A Partner

The Curlec Partner Programme is tailored for e-commerce enablers, including web or app developers, technology platform providers, online learning platforms, or even food ordering systems, and more. If you play a role in enabling websites to collect payments, this is the platform to expand your reach and offer innovative solutions to your clients.

About the Curlec Product Suite

Our products reflect the culmination of local expertise and global innovation. Firstly, the Curlec Payment Gateway, a cornerstone of our offerings, ensures seamless transactions without redirects, fortified by robust security measures, and boasts responsive local support. The checkout experience is like none other, where your clients can customise with their brand logo and colours to enhance branded touchpoints and foster trust.

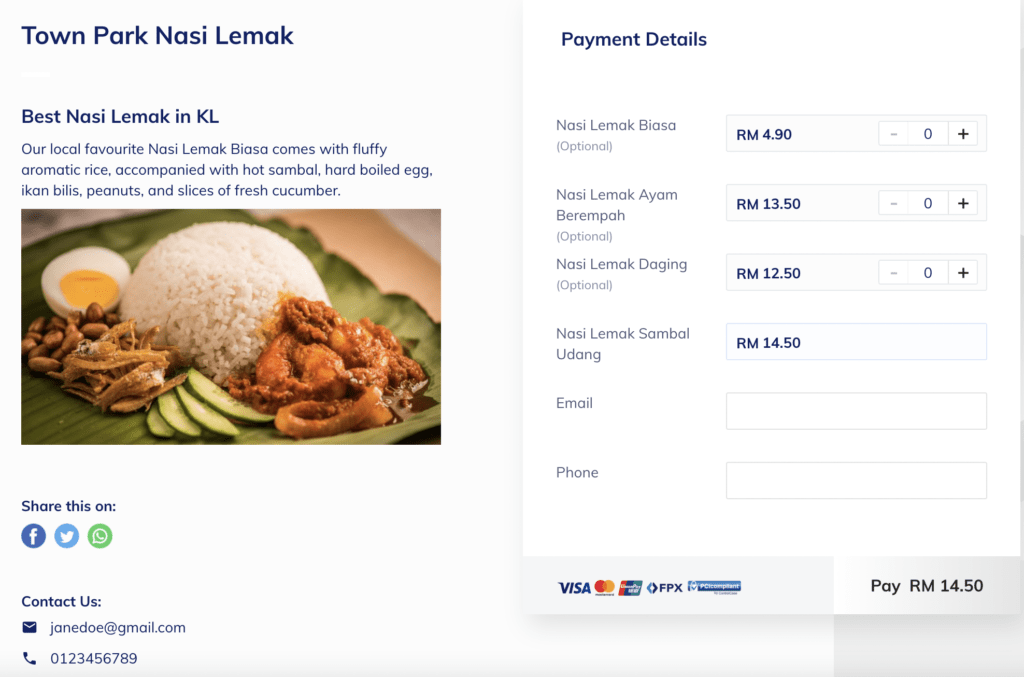

Besides that, we also have no-code tools such as Payment Pages, Payment Links, and Payment Buttons – crafted for simplicity, functionality, and efficiency. Integration is extremely easy through our plugins and extensive APIs. What’s more, we also provide custom integrations if need be, so you can provide flexibility to your clients with our payment solutions easily.

A Programme Designed for Growth

Becoming a partner with Curlec is more than aligning with a payment solution; it’s joining a narrative of local success that’ll be elevated to global standards. With an easy integration process and steadfast commitment to collective growth, the Curlec Partner Programme invites you to take the leap today. So if you’d like to know more or how you can be a partner, send us an email to hello@curlec.com and our Partnership Manager will guide you through it all.