The whole nation is buzzing with the upcoming mandatory implementation of e-invoicing, which will roll out in three phases;

Targeted Taxpayers | Implementation Date |

Taxpayers with an annual turnover or revenue of more than RM100 mil | 1 August 2024 |

Taxpayers with an annual turnover or revenue of more than RM25 mil and up to RM100 mil | 1 January 2025 |

All taxpayers | 1 July 2025 |

The Curlec Connect x BRO Santai Session panel discussion happened aptly, as we gathered Dr. Rasyidah Che Rosli, Director of e-Invoice Division, Tax Operations Department from LHDNM, Puan Hafizan Urif, Chief Financial Officer from Serai Group, and our very own Senior Business Development Manager, Rizqan Izari to share valuable insights on e-invoicing for Malaysian businesses. We’ll delve into the key takeaways here:

What Are The Benefits of E-Invoicing?

Seamless Operations

The primary aim of e-invoicing is to digitalise and increase the efficiency of Malaysian businesses. By transitioning from manual to digital processes, e-invoicing minimises human error and reduces the need for manual intervention. This shift aligns with the national blueprint for digitalisation, promoting a more streamlined and automated approach to business operations.

Cost-saving

Automation is a big part of e-invoicing, which can lead to significant time and cost savings. This can help boost smaller retailers and enterprises alike. Processes that can be automated will ensure that invoices are submitted and validated in real-time by the LHDNM (Inland Revenue Board of Malaysia). This creates a smooth and continuous flow of information in real time, enhancing the overall experience for most businesses in the long run.

How to Start Implementing E-Invoicing?

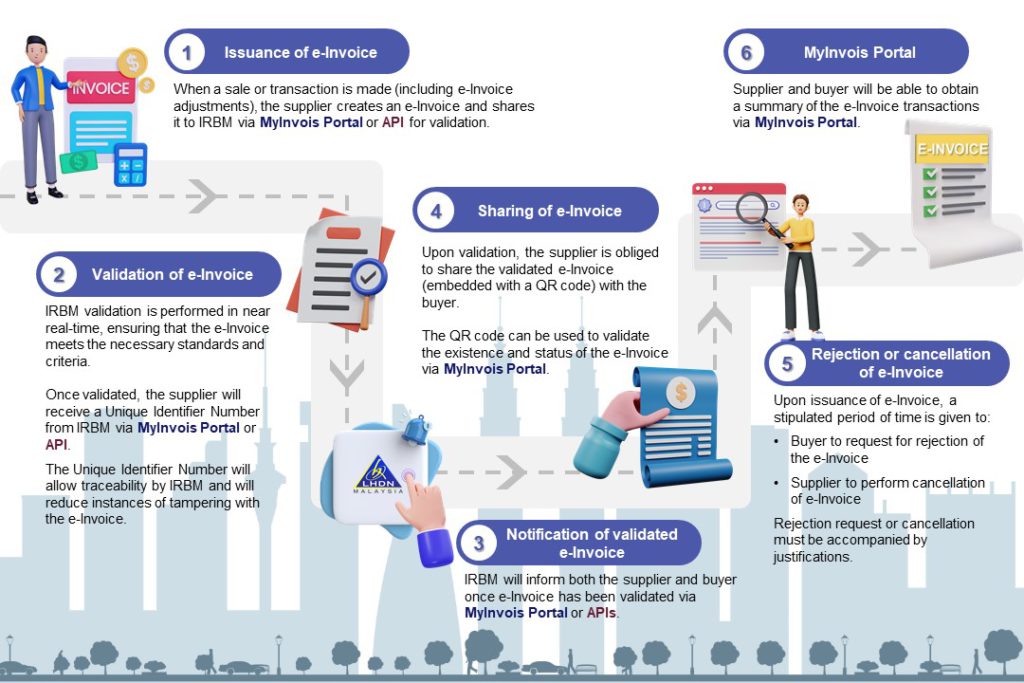

MyInvois Portal

For businesses without their own invoicing system, the MyInvois Portal provides a user-friendly solution. This portal is especially beneficial for small businesses that can use LHDNM’s platform to manage their invoicing needs.

API Integration

For larger businesses with existing ERP systems, they can integrate directly with LHDNM through APIs. This method allows for seamless integration and communication between the business’s internal systems and LHDNM’s framework. Software Development Kit (SDK) are readily available to help businesses adjust and enhance their systems to comply with e-invoicing requirements.

(Source: https://www.hasil.gov.my/en/e-invoice/overview-of-the-e-invoice-model/)

Security Concerns

Data Security

The shift to e-invoicing involves handling sensitive taxpayer information, which undoubtedly raises concerns about data security. It’s common, but the concerns are addressed accordingly. The e-invoicing systems will use digital signatures for authentication and authorisation purposes. This ensures that only authorised individuals can submit invoices on behalf of businesses. Eliminating any loopholes or breaches.

Cybersecurity Measures

Additionally, to comply with the highest cybersecurity standards, third-party audits ensure that all processes meet stringent security requirements. The implementation of security tools and system availability measures further protects the integrity and confidentiality of business data when it’s e-invoicing related.

Economic Impacts

Cost Reduction

Digitalisation and automation through e-invoicing can significantly reduce operational costs. According to Dr Rasyidah, experiences from other countries show that e-invoicing can cut costs by up to 50%, making it a financially beneficial move for businesses of all sizes in Malaysia.

Grants and Incentives

To encourage the adoption of e-invoicing, grants under MCMC and MDEC are available*. These grants provide incentives for businesses to support their digital transformation journey. Additionally, MSMEs (Micro, Small, and Medium Enterprises) can benefit from tax reductions, further easing the financial burden when transitioning to e-invoicing.

*Terms and conditions apply.

For A Smooth Transition

These are the main takeaways from the panel discussion on e-invoicing. In a nutshell, businesses are encouraged to start early by identifying the right payment provider that can assist in issuing e-invoicing. Luckily, Curlec can provide just that; a Payment Gateway that can create, send, and track unlimited invoices. One with simple integration to ERPs and accounting systems.

If you’d like to learn more about Curlec E-invoices:

Invoices

Invoices